The Federal Reserve held back on Thursday from raising interest rates for the first time in years. But it will eventually, maybe later this year.

Whatever the timing, a rate hike will have implications for millions of Americans. It’s important if you have a credit card or savings account, invest in a 401(k) or in the markets, or want to buy a home or car.

The Fed slashed interest rates to zero in December 2008 to help stimulate the economy and housing market during the depths of the Great Recession. The economy is much better now.

The first rate hike won’t be a game changer overnight. But it will pave the way for more hikes over the next year or two, and rates on all types of things will gradually move up, experts say.

“The precise starting date [of rate hikes] is much less important than the path of rate increases that follows,” says Robert Denk, senior economist at the National Association of Home Builders.

Here’s what you need to know about a Fed rate hike.

1. Home buyers: Interest rates are still very low

Relax. You don’t need to rush to buy a home or get a car loan tomorrow. Interest rates, even when they are raised, are still low and will remain historically low for quite some time.

The Fed’s eventual first move is expected to be small — a maximum of about 25 basis points, or an increase to 0.25% from 0%. In the world of interest rates, that’s like bunting a baseball.

The average interest rate on a typical 30-year fixed rate mortgage is 3.9% right now. Ten years ago that rate was near 6% and 20 years ago it was 7.5%, according to the St. Louis Fed. So yes, rates will likely be higher in a year but still low when compared to historical averages.

The Fed sets a target rate for very short-term debt. But that rate also influences interest rates on mortgages, car loans and other big-ticket items.

But none of the impact will happen overnight, experts say.

“We don’t expect mortgage rates to skyrocket,” says Greg McBride, chief financial analyst at Bankrate.com.

2. Savers can (eventually) smile

The first rate hike would be the light at the end of the tunnel for savers who’ve seen zero interest in their savings accounts and certificates of deposit.

That will begin to change … slowly. McBride of Bankrate warns that savers should not expect big banks to start offering higher interest on their deposits immediately.

Still, the Fed’s first rate hike will be a step in the right direction. It will mean there will likely be more rate increases in the near future (the next 1-2 years), and that eventually should mean higher interest on your deposits.

Experts say savers will be able to expect to see a more typical interest rate within a couple years, so you still need to be patient.

3. Stock markets could get even more volatile

If you invest in stocks or ETFs, or even if you just have a 401(k); a Fed rate hike will be important to you and your portfolio.

August was a very volatile month for stocks, and a rate hike could trigger even more volatility in U.S. and overseas stocks.

Sometimes a Fed rate hike causes investors to pull their investments out of developing economies like India and Mexico. Even a slightly higher interest rate in the U.S. can encourage some investors to put their cash in safe assets like U.S. government bonds, and get out of less safe assets abroad.

Already this year, investors have pulled $1 trillion out of emerging markets. If you own stocks or ETFs of overseas stocks, it could be a rocky couple of months. We’re not saying sell your stocks, sometimes volatility can present a buying opportunity. We’re saying be prepared to handle some volatility in global stock markets.

No one has a crystal ball and knows how the market will react. So far this year, whenever news suggested the Fed might raise rates, stock markets generally went down, and the opposite happened when economic news suggested a rate hike might be pushed off.

The best educated guess is that a rate hike could cause some market volatility at least in the short term.

4. Will the global gloom continue?

Sometimes economists refer to the Fed as the “World’s Central Bank” because its actions have lots of implications for global economies. Ultimately what’s bad news overseas ends up hurting the U.S. too.

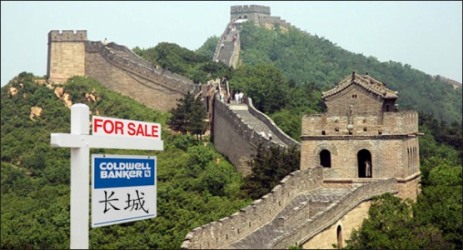

China’s economy is already slowing down and developing economies are struggling with plunging currencies and low commodity prices.

The concern is that the Fed’s rate hike can cause a boomerang effect: (1) the Fed raises rates, (2) that hurts other economies even more, and then (3) economic woes in developing countries eventually hurt U.S. trade and economic growth.

A rate hike has upsides and downsides, says Diane Swonk, chief economist at Mesirow Financial. The U.S. economy could gain additional moment um behind home buyers trying to lock in low mortgage rates.

“The downside risks, however, is that a rate hike adds insult to injury in an uncertain world and causes a moderation in growth,” says Swonk.