If you’re thinking about purchasing a home, sooner might be better than later when it comes to favorable conditions for buyers.

Buying a home is a major financial decision that you shouldn’t rush into. But that doesn’t mean you should take your sweet time either. The real estate market is volatile, and truth be told, this year might be your last chance to affordably buy a home for awhile.

“If you qualify for a mortgage and choose not to buy now, you will be kicking yourself in 12 months,” says Anthony VanDyke, president of ALV Mortgage in Utah.

Thanks to a dearth of inventory, home prices are projected to increase by 6.3 percent nationwide from April 2014 to April 2015, according to a recent study by Corelogic, a leading global property information, analytics, and data-enabled services provider.

Just how much could that increase cost you? More than you might think.

“On a $300,000 house today, the same house will cost you $318,000 in one year,” says VanDyke.

The difference isn’t mere pocket change. So if you’re in the market to buy a home, read on for more reasons why this year could be a prospective homeowner’s last chance to buy an affordable home.

Reason to Buy Now #1: Low for-sale inventory means homes will become more expensive

A low inventory of homes for sale keeps house prices up, according to California-based mortgage banker, Michael Regan, of the Regan Team.

“It’s simple supply and demand,” says Regan. “The less you have of something, the more expensive it will become.”

Just how did we get into this increasingly low-supply, high-price environment? According to Regan, there are a few causes.

“With the limited housing inventory in many markets, and with last year’s home price increases, many people couldn’t afford to buy a home and rented instead,” he says. “Because of the Great Recession, the building of new homes and rental units was almost nonexistent for years and didn’t keep up with population growth.”

With a shortage of housing and rental units available, Regan says housing prices and rents have increased, leading to affordability issues. The good news is that this supply and demand issue will solve itself once more housing units are built to accommodate the population growth and young families looking for homes, says Regan. But the bad news is that it could take a while, and prices will climb until then. So now might be a good time to buy, before prices peak, he explains.

Reason to Buy Now #2: The Fed plans to taper off bond-buying program in October

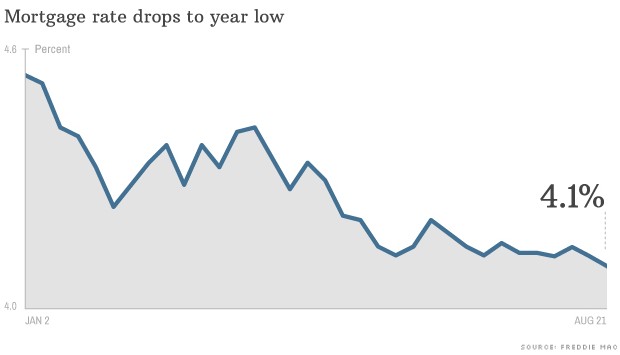

With the economy improving and the unemployment rate dropping, the Federal Reserve tentatively plans to end their bond-buying program in October. The end of the program, which was aimed to keep interest rates low, is expected to result in higher interest rates, and any increase in interest rates could create even less favorable conditions for buyers, says Van Dyke.

According to the MBA Mortgage Finance Forecast, interest rates on 30-year fixed-rate mortgages are projected to jump half a percentage point in early 2015 from the year before.

On a 30-year conventional mortgage of $300,000, an increase from 4.4 to 4.9 percent means paying an extra $90 each month or more than $30,000 in interest over the life of the loan. So that half point difference can translate into a hefty chunk of cash for any home buyer.

“Rising rates can have just as big an impact on affordability as does rising prices due to low housing inventory,” says Ellen Davis, a Maryland-based senior mortgage loan originator with Corridor Mortgage Group.

When mortgage rates increase, Davis says borrowers experience greater difficulty qualifying for a home loan.

“Higher interest rates increase a borrower’s overall debt to income ratio, and depending on their current situation, they may end up no longer qualifying based on underwriting guidelines. Even if they do qualify, they may not be comfortable with the higher monthly debt payment and may choose to reduce the amount of home they are willing to purchase or put off the purchase indefinitely,” says Davis.

So what’s the take home here?

“While you’ve missed the bottom of the market with home prices, interest rates are still very low,” according to Regan. Don’t risk rates going up, he says, which can ultimately cost you big on your home’s price tag.

Reason to Buy Now #3: The current economy’s flat wages threaten to make homes less affordable

When was the last time you heard of companies giving out big bonuses and substantial salary raises? Save a few high-growth industries, flat wages have been the rule, not the exception. If home prices continue to increase, housing could in theory become less affordable if your take-home pay doesn’t keep up with its growth.

“History has shown us that there is always the chance that home prices are pushed out of reach when wages are flat,” says Davis. “Then at some point, some sort of correction in wages or housing occurs, and the correlation between the two sectors becomes more sustainable.”

The question then becomes, when will this tipping point occur, and can you afford to wait?

According to Davis, homes will be more affordable once all areas of the market – stocks, bonds, home prices, wages, government spending and debt, etc. – are working together to create jobs. And better employment figures translate into more income, leading to wealth, economic growth, and ultimately consumer confidence, which in large part helps drive home purchases, she explains.

Sounds ideal, right? Well, don’t hold your breath. It’s impossible to predict when this synergy will take place, so now is as good a time as any to buy a home you can comfortably afford, says Davis.

Reason to Buy Now #4: Beat other home buyers to the punch before competition heats up

Maybe you’ve been renting and managed to save up a nice nest egg. Or maybe you’ve just outgrown your current space. Well, you might want to take the plunge and buy a home once you’ve found something that you can afford.

Why now? Because the housing market is about to get even more competitive. According to Davis, the pent-up demand of younger professionals, who moved back in with their parents during the recession, is about to explode. And as these young people move out and form new households of their own, they will drive up housing demand, she explains.

This eager subset of buyers will create some steep competition for homes, especially if they have been saving up to make larger down payments or high ticket offers, says Davis.

“If the current homes on the market have more potential buyers, bidding wars develop, and the purchase prices are driven up,” says Davis. While the competition helps the overall home values in the area, it also inflates prices to the point where homes are no longer affordable for a large percentage of potential home buyers, she explains.

And it’s only going to get worse as more and more young professionals feel ready to buy, so it’s a smart move to buy now and avoid the potential price gouging altogether. Once you’re officially a homeowner, you can welcome rising prices, because your home’s value will shoot up, according to Davis. “This is good for the individual homeowner as well as for the broader economy,” she says.